공지사항

| Loan Application Tips: How to Prepare for a Successful Loan Request | Helen | 25-02-27 15:47 |

|

Applying for a mortgage is often a vital financial choice, and correct preparation can increase your possibilities of approval and secure favorable phrases. Whether you're in search of a private loan, business mortgage, or mortgage in Canada, these loan software suggestions will assist you to navigate the process successfully and enhance your probability of success.

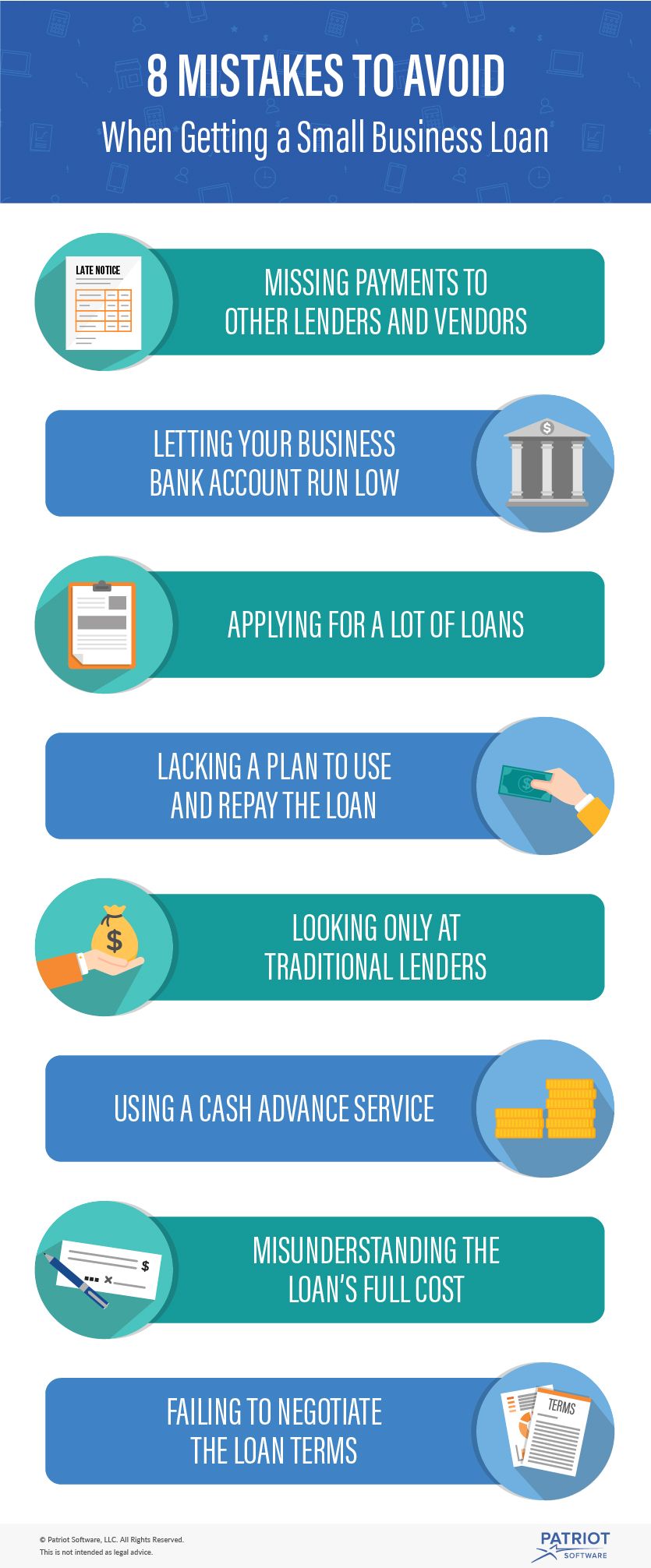

1. Check and Improve Your Credit Score Before making use of for a loan, acquire a duplicate of your credit score report and evaluation your Bad credit loan: Mistakes to avoid in 2025 rating. Take steps to improve your Bad credit loan: Mistakes to avoid in 2025 score if wanted by paying down present debt, correcting errors on your report, and making timely payments on outstanding accounts.  2. Understand Your Financial Situation 2. Understand Your Financial SituationEvaluate your financial place and determine how much you can realistically afford to borrow. Consider your earnings, bills, and existing debt obligations to ascertain a transparent understanding of your monetary capability. three. Research Lenders and Loan Options Explore totally different lenders and loan products obtainable in Canada. Compare rates of interest, charges, reimbursement terms, and eligibility criteria to identify lenders that align along with your financial needs and goals. 4. Gather Necessary Documentation Prepare essential paperwork required for the loan application course of, corresponding to proof of id (government-issued ID), proof of income (pay stubs or tax returns), bank statements, and employment verification. 5. Calculate Your Debt-to-Income Ratio Calculate your debt-to-income ratio (DTI) to assess your ability to manage additional debt. Aim for a DTI below 40% to show monetary stability to lenders. 6. Determine the Purpose of the Loan Clearly outline the aim of the mortgage and the way the funds might be utilized. Whether it's for home improvements, debt consolidation, business growth, or training, lenders recognize debtors with a specific and strategic plan for the mortgage proceeds. 7. Complete the Application Accurately Fill out the mortgage utility type accurately and in truth. Provide all required data and altercash.Ca be ready to elucidate any discrepancies or gaps in your monetary historical past.  8. Consider Secured vs. Unsecured Loans 8. Consider Secured vs. Unsecured LoansUnderstand the difference between secured and unsecured loans. Secured loans require collateral (such as a home or vehicle) and sometimes have lower interest rates, whereas unsecured loans don't require collateral but may have larger interest rates. 9. Review Loan Terms and Conditions Thoroughly review the phrases and circumstances of the mortgage, including interest rates, compensation schedule, charges, and penalties for early reimbursement or late payments. Clarify any uncertainties with the lender earlier than signing the agreement. 10. Maintain Communication with the Lender Stay involved with the lender throughout the mortgage application process. Respond promptly to requests for added info or documentation to expedite the approval process. Conclusion By following these loan application tips and taking a proactive approach to your monetary preparation, you probably can current your self as a reputable and accountable borrower to lenders in Canada. Remember to evaluate your monetary readiness, analysis mortgage options completely, and talk openly with lenders to secure the most effective loan phrases potential. |

||

| 이전글 통영 중고 오토바이매입 출장 바이크 모든기종 매매 할리 전문매장 |

||

| 다음글 흥신소 탐정 선정시 100% 실패없는 성공 공식 |

||

댓글목록

등록된 댓글이 없습니다.