공지사항

| Understanding Business Valuation Reports in Canada | Clarence | 25-02-25 09:54 |

|

If you might be planning to purchase or promote a enterprise in Canada, you will need to know the value of the business. Business valuation is the process of figuring out the economic value of a enterprise or an organization. It is a important step in the process of buying for or promoting a enterprise. Business valuation stories present an in depth analysis of the value of a business. In this article, we will talk about business valuation reports in Canada and what they embody.

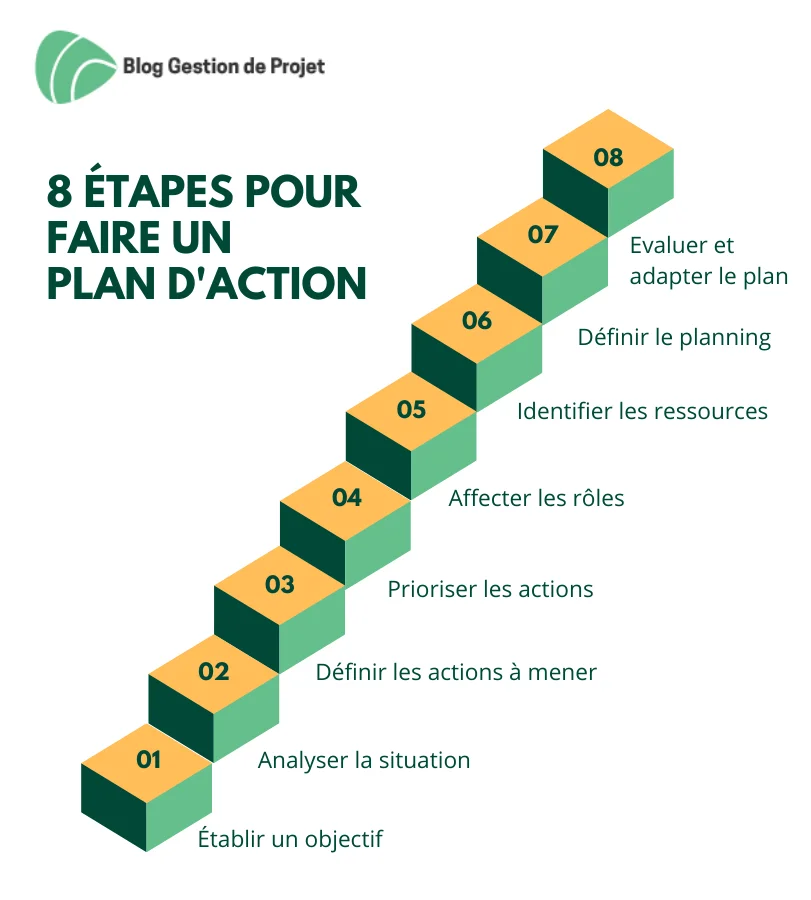

Business valuation stories in Canada are prepared by certified business valuators (CBVs) who're members of the Canadian Institute of Chartered Business Valuators (CICBV). CBVs are experts in business valuation and have undergone rigorous coaching and testing to become licensed. They use completely different strategies to find out the value of a business, similar to revenue, market, and asset-based approaches.  A enterprise valuation report usually includes the next: A enterprise valuation report usually includes the next:1. Executive Summary: This section offers an summary of the report and the conclusions reached by the CBV. 2. Business Description: This part supplies an outline of the enterprise, its historical past, products/services, trade, and market. three. Financial Analysis: This section features a evaluate of the corporate's monetary statements, such as revenue statements, steadiness sheets, and cash flow statements. four. Valuation Methods: This section describes the strategies used to find out the worth of the enterprise, such as the income, market, and asset-based approaches. 5. Valuation Conclusion: This section provides the CBV's opinion of the value of the business, primarily based on the methods used. 6. Assumptions and Limitations: This section outlines the assumptions made and the constraints of the report. 7. Appendices: This part includes supporting paperwork and information, corresponding to financial statements, trade reviews, and market information. It is important to notice that a enterprise valuation report is not just a quantity. It is a complete analysis of the enterprise, bearing in mind all related elements that affect the value of the business. A CBV offers an goal and unbiased evaluation of the business's worth, Modèle de plan d'action : Quelles sont les étapes clés à suivre ? which is essential for making knowledgeable choices when shopping for or selling a business. In conclusion, enterprise valuation reports are important for determining the value of a enterprise in Canada. They provide an in depth evaluation of the enterprise, bearing in mind varied factors that affect its value. If you're planning to buy or promote a enterprise, you will want to work with a certified business valuator who can provide an goal and independent evaluation of the business's worth. |

||

| 이전글 역사의 흐름: 인류의 과거와 미래에 대한 고찰 |

||

| 다음글 신당동 누수탐지 전세집 천장 누수 책임 대처법 |

||

댓글목록

등록된 댓글이 없습니다.