공지사항

| Guide To Korkot Online: The Intermediate Guide In Korkot Online | Dieter | 25-10-28 12:41 | |||||||||||||||||||||

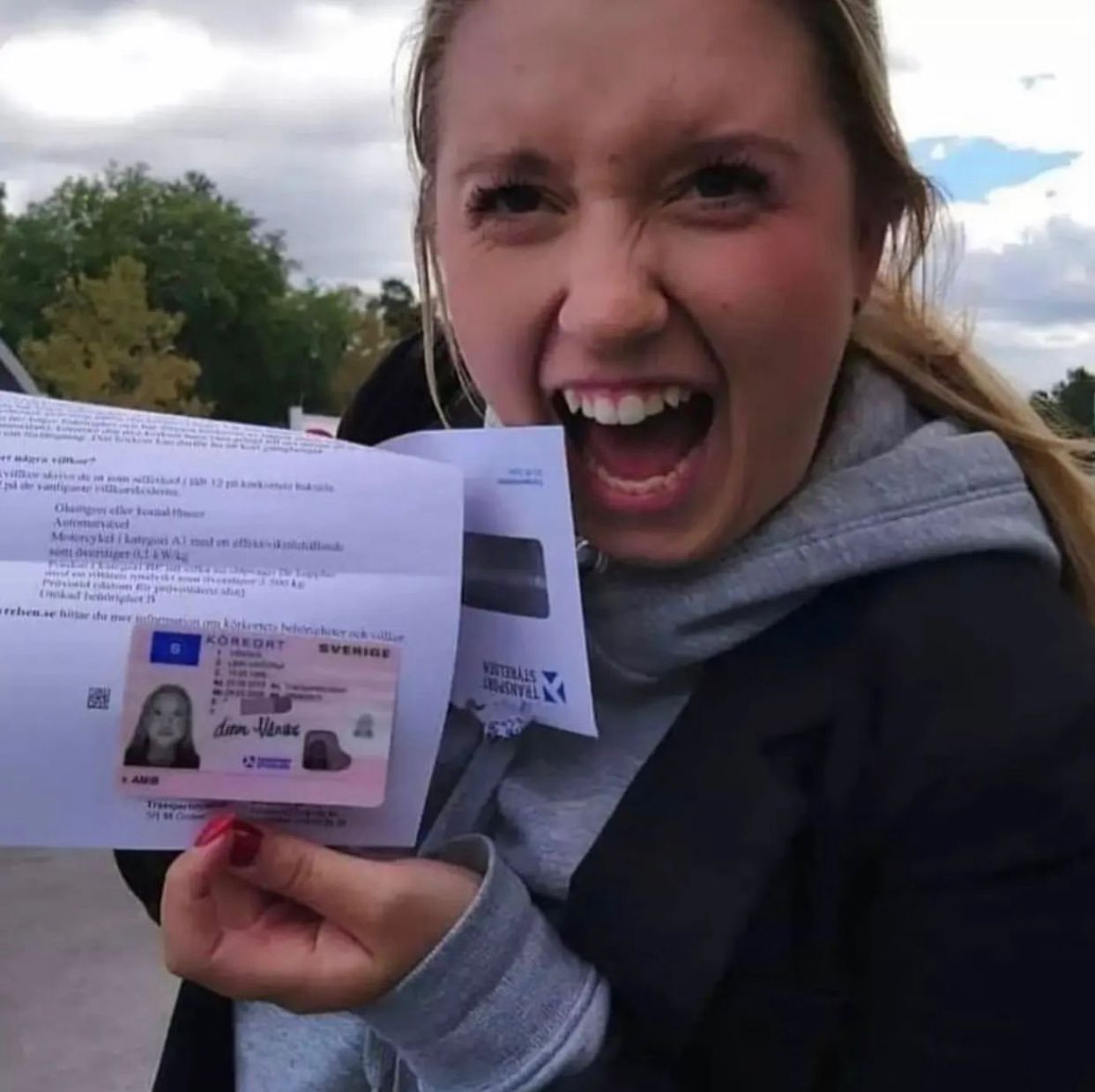

Korkot Online: Revolutionizing Lending in the Digital AgeOver the last few years, köpa körkort online the rise of online platforms has changed various markets, and lending is no exception. Amongst the myriad of online loaning platforms, Korkot Online has actually emerged as a popular competitor. This article intends to explore the functional intricacies of Korkot Online, its advantages, challenges, and the general impact it has on the lending landscape.  Comprehending Korkot OnlineKorkot Online is an ingenious platform that supplies loans to individuals and organizations through a smooth online interface. Utilizing sophisticated algorithms and innovation, Korkot Online enhances the borrowing procedure, making it accessible and effective for a more comprehensive audience. The platform separates itself by offering competitive rates of interest, a range of loan options, and an expedited approval procedure. Key Features of Korkot Online

How Korkot Online WorksThe Korkot Online borrowing procedure is uncomplicated, which can be broken down into a number of actions:

Advantages of Korkot OnlineKorkot Online brings numerous advantages to the table, including:

Obstacles Faced by Korkot OnlineDespite its benefits, Korkot Online is not without obstacles:

The Impact of Korkot Online on the Lending LandscapeThe emergence of platforms like Korkot Online has considerably changed the financing ecosystem. Traditional banks and Cv Körkort cooperative credit union are adapting by presenting their online platforms, leading to more choices for debtors. Furthermore, online lending has increased competition, engaging lending institutions to improve their services and offer better rates. Korkot Online is likewise playing a vital function in financial addition, permitting people and small companies who may otherwise be excluded from traditional banking systems to access funds. Table: Comparison of Korkot Online vs. Traditional Lending

Frequently Asked Questions about Korkot Online1. Is Korkot Online safe to use?Yes, Korkot Online uses innovative file encryption technology to protect user information and ensure a secure borrowing experience. 2. What credit rating is needed to qualify?While having a great credit report enhances your chances of approval, Korkot Körkorts Online considers different elements in its assessment, so individuals with lower scores might still potentially qualify. 3. Can I pay off my loan early?Yes, Korkot Online usually permits customers to pay off their loans early without incurring prepayment penalties. 4. How does Korkot Online validate my earnings?Korkot Online may use document uploads, bank declarations, or automated confirmation systems to validate your income during the application process. Korkot Online represents a dynamic shift in the financing scene, supplying convenience and efficiency that exceeds some traditional loaning downsides. As the platform continues to progress, it highlights the importance of regulative compliance, security, and customer care in establishing trust with customers. By cultivating financial inclusion and competitors within the financing space, Korkot Online is leading the way for a more accessible and efficient borrowing experience that shows the requirements these days's customers. In conclusion, Korkot Online is not just an option for people seeking loans but a reflection of a broader improvement occurring within the monetary sector, where innovation meets the requirement for inclusion and availability.  |

|||||||||||||||||||||||

| 이전글 See What Bean Cup Coffee Machine Tricks The Celebs Are Using |

|||||||||||||||||||||||

| 다음글 You'll Be Unable To Guess Conservatory Installation Specialists's Benefits |

|||||||||||||||||||||||

댓글목록

등록된 댓글이 없습니다.